Welcome to NilPay paymentmade unique! for payment solutions.

Welcome to NilPay payment, the next-generation payment solution for NGOs, government bodies, and organizations. Our cutting-edge platforms and tools empower you to effortlessly manage both offline and online payments. With a focus on innovation and user-friendly experiences, we provide a seamless solution for aid and cash disbursements. Backed by major venture capitalists in Sudan, we are leading the way in fintech and developmental projects. Join us to unlock a new era of simplified and secure payment solutions.

Trusted by these companies so far

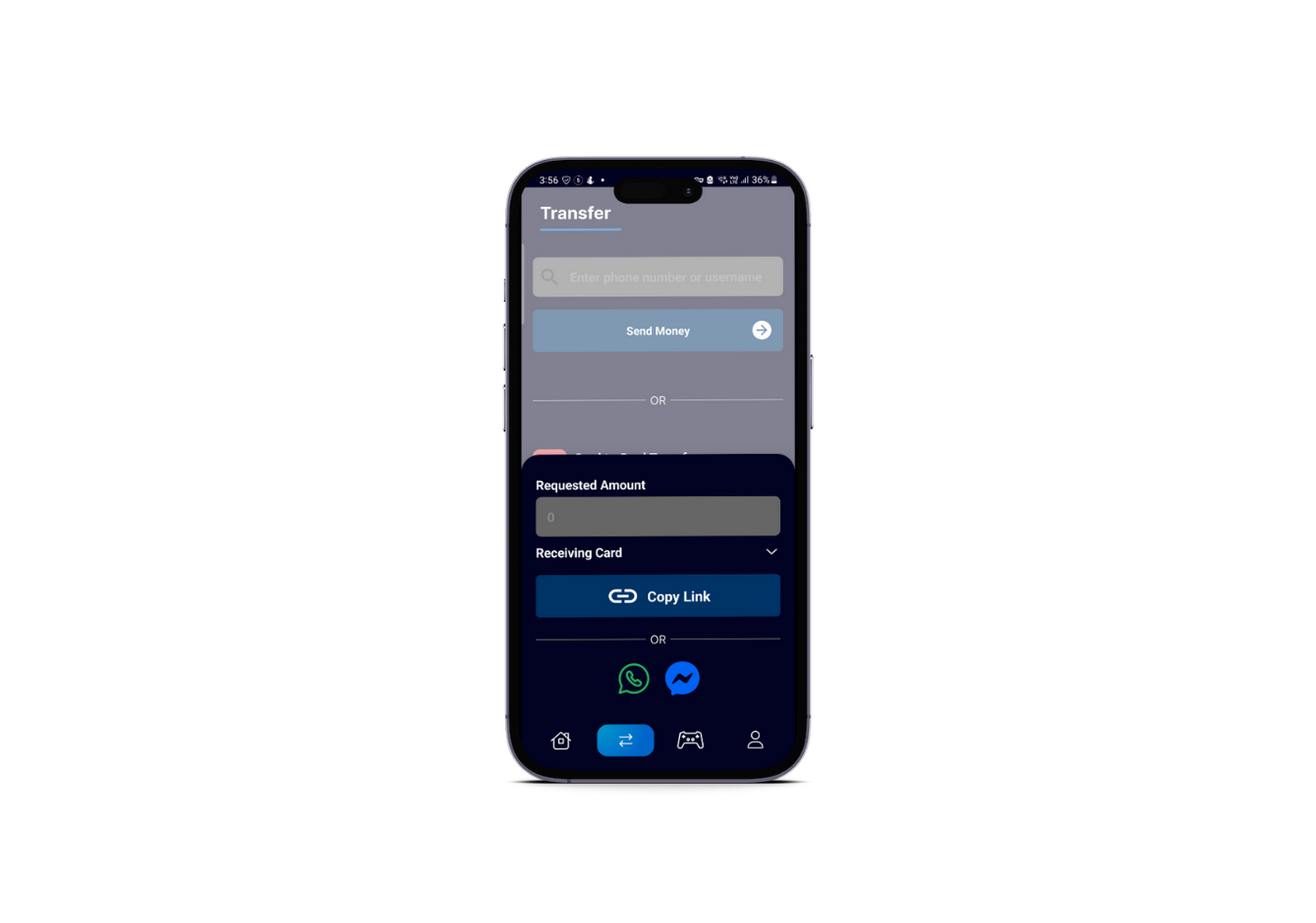

Get the NilPay app

Manage payments on the go. Download the NilPay wallet for Android and enjoy offline and online payments in one place.

The Problem

In the face of a devastating war crisis & conflict, Sudan's banking system is virtually non-existent, leaving millions without access to basic financial services. The challenge is further amplified by frequent power and internet outages.

Banking Collapse

Sudan's financial infrastructure has deteriorated, leaving citizens without reliable banking services.

Financial Exclusion

Millions of Sudanese people have no access to savings, payments, or other essential financial tools.

Infrastructure Challenges

Unreliable power and internet connectivity further complicate access to any remaining financial services.

Empower Your Financial Future with NilPay

Take control of your funds management and financial transactions. NilPay offers innovative solutions designed for IDPs, immigrants, and individuals looking for a seamless and secure payment experience. Whether it's offline or online payments, our omnichannel platform has got you covered.

About NilPay

Welcome to NilPay - a digital platform revolutionizing the payment landscape in Africa starting with Sudan. In the midst of a war crisis and a collapsed banking system, we saw an opportunity to create a solution that empowers Sudanese people and organizations with seamless, reliable financial services.

Our Mission

Our mission is to revolutionize the payment landscape in Africa by offering a trusted, digital platform that enables offline transactions and agency banking solutions. We strive to provide crucial financial services to our customers even in the most challenging conditions

Our Vision

Our vision at NIL Payment is to become the leading digital payment platform in conflict- affected regions, providing reliable and secure financial services to empower individuals and facilitate the operations of humanitarian organizations.

Our Values

Resilience, innovation, and commitment to serving communities in need, even in the most challenging circumstances.

NilPay Services

Innovative financial solutions designed for challenging environments

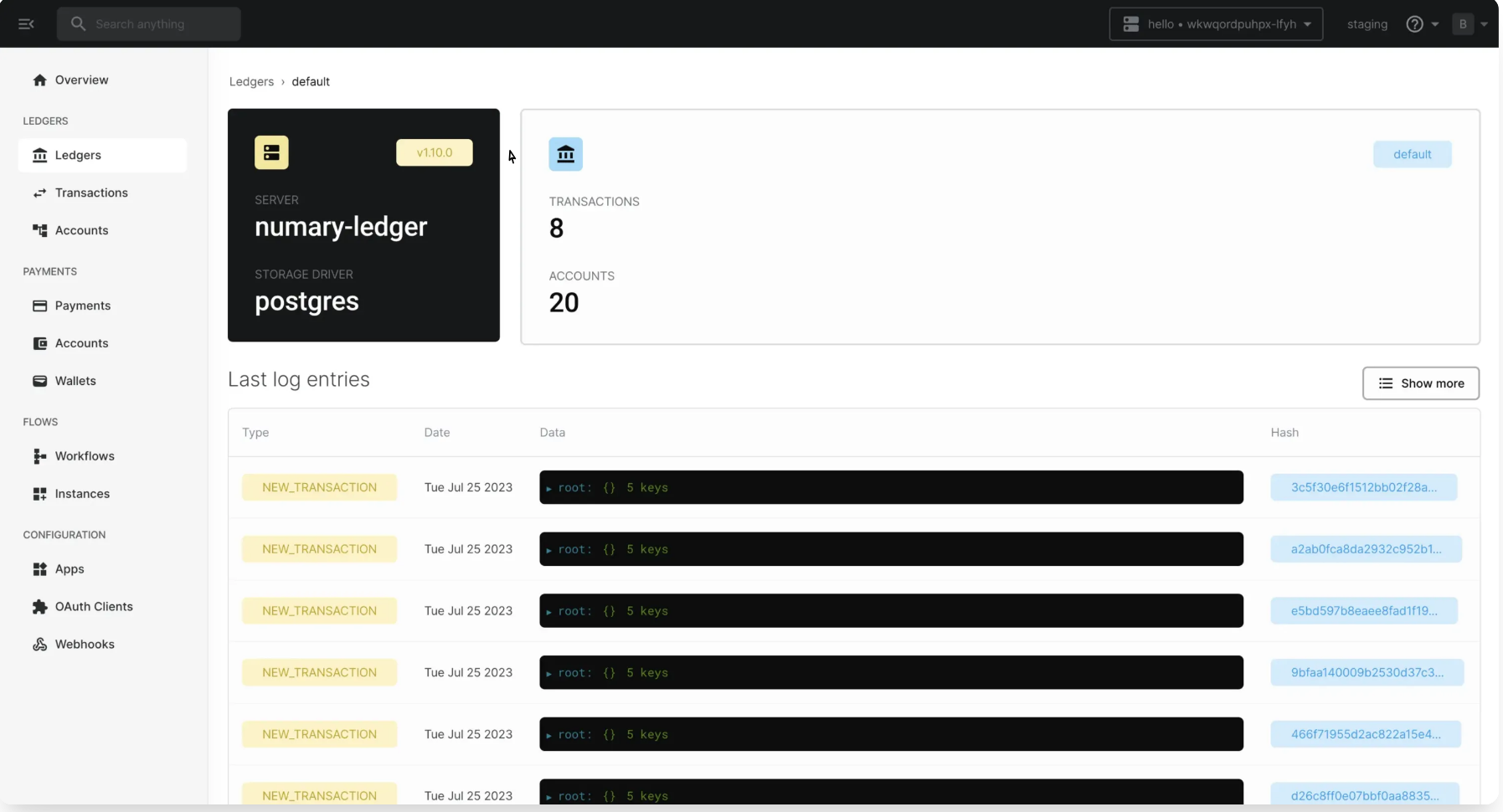

Our digital wallet allows users to securely store funds, make payments, purchase airtime and pay bills directly from their NilPay Wallets. With the ability to work offline, our digital wallet is designed to function seamlessly even in challenging conditions.

We offer multiple specialized models for NGOs operating in Sudan, providing them with a secure and reliable system to manage their finances, including cash-based management for development programs and humanitarian assistance.

Our network of well incentivized agents & merchants enables us to provide financial services in remote areas as well. This agency banking solution ensures that even those without access to traditional banking services can perform financial transactions through our solution.

Simplify everyday business tasks.

Payment Solutions

Offer seamless and secure payment solutions for the unbanked.

Provide a user-friendly and secure payment platform tailored for the unbanked. Our solution utilizes technology to ensure secure and tamper-proof transactions.

Utility Payments

Pay your bills with ease and confidence.

Never miss a payment date with our utility payment feature. Pay your bills directly from our platform, pay for electricity, water, or telecom services. Enjoy the convenience of paying all your bills in one place.

Humanitarian Aid Platform

Supporting those in need with efficient aid disbursement.

Our platform facilitates NGOs in distributing cash-based aid effectively. We ensure that your aid reaches those who need it the most, especially in times of crisis.

Offer seamless and secure payment solutions for the unbanked.

Provide a user-friendly and secure payment platform tailored for the unbanked. Our solution utilizes technology to ensure secure and tamper-proof transactions.

Pay your bills with ease and confidence.

Never miss a payment date with our utility payment feature. Pay your bills directly from our platform, pay for electricity, water, or telecom services. Enjoy the convenience of paying all your bills in one place.

Supporting those in need with efficient aid disbursement.

Our platform facilitates NGOs in distributing cash-based aid effectively. We ensure that your aid reaches those who need it the most, especially in times of crisis.

Take NilPay with you

Install the NilPay wallet on your Android device for secure, seamless payments—online or offline.

Empower the Unbanked with NilPay Payment Solutions.

Experience our integrated end-to-end digital platform designed to provide payment solutions and services for the unbanked. With a suite of solutions including a digital funds platform, mobile money enablement, and cards and mobile wallets enablement, we empower individuals to access financial services easily and securely.

Experience seamless and secure payment solutions tailored for the unbanked. Our integrated digital platform provides a comprehensive suite of services, including a digital funds platform and mobile money enablement.

Our Team

Led by experts with a vision to transform financial services in underserved regions

NilPay is led by a team with over 20 years of combined experience across FMCG, financial services, telecom, banking, and development sectors. Our founders bring diverse expertise in technology, finance, and humanitarian work, uniquely positioning us to address the challenges faced by underserved populations.

Our team's experience spans countries such as Sudan, South Sudan, Somalia, and Djibouti, giving us deep insights into the unique challenges and opportunities in these markets. This regional expertise allows us to develop solutions that are truly tailored to local needs.

With backgrounds across multiple sectors including technology, finance, and humanitarian work, our team brings a multidisciplinary approach to solving complex financial inclusion challenges. This diverse expertise enables us to create innovative solutions that bridge traditional gaps.

Operating in Sudan's nascent fintech sector, NilPay stands out with minimal competition and immense growth potential. Our team is driven by the urgent need to provide reliable financial services to underserved populations, positioning us at the forefront of financial innovation in the region.

Frequently asked questions

If you can’t find what you’re looking for, email our support team and if you’re lucky someone will get back to you.

Target AreaPrimary Focus

Africa, and particularly the Horn of Africa, represents a significant untapped market for fintech services. With a large percentage of the population unbanked and a growing trend of mobile phone usage, the region presents a unique opportunity for NilPay.

Our services are designed to cater to traditional consumers, Internally Displaced Persons (IDPs), and immigrants who often face difficulties accessing financial services.

By focusing on these underserved demographics across various African regions, we aim to drive financial inclusion while positioning our company for substantial growth in these emerging markets.

Regional Strategy

Horn of Africa

Primary target market with high unbanked population and mobile adoption

East Africa

Secondary expansion market with growing fintech adoption

North Africa

Future expansion market with established banking infrastructure

West Africa

Potential long-term expansion area with diverse economies

Central Africa

Emerging market with untapped potential

Southern Africa

More developed market with opportunities for advanced fintech solutions

Global View

Horn of Africa

Ethiopia, Somalia, Eritrea, Djibouti